The 2024 Budget which has been tagged the “Budget of Renewed Hope” was signed into law on the 1st of January 2024 by the President of the Federal Republic of Nigeria; President Bola Ahmed Tinubu. The Budget represents a major milestone towards improving the overall health of the Nigerian economy and restoring macro-economic stability. In tandem with the last administration’s effort to keep to a consistent budget cycle, it was a relief to see the trend continue with the current administration.

The President in his speech at the Joint Session of the National Assembly on Wednesday, November 29, 2023, highlighted the priority areas for the Federal Government in the 2024 Appropriation Act. Primarily, the Budget is focused on setting the tone for achieving: job-rich economic growth, macro-economic stability, improved investment environment, enhanced human capital development, poverty reduction, and greater access to social security. The President further noted that defense and internal security, human capital development, investment in education, and a greener and sustainable economy remain the core elements of his administration’s budget objectives.

The budget proposal is underpinned by the assumptions outlined in the multi-year Medium Term Expenditure Framework (MTEF) 2024 -2026 and Fiscal Strategy Paper (FSP) which serve as a vital tool for prudent fiscal management and resource allocation. The Medium-term Expenditure Framework takes into account factors such as inflation, lending rate, currency exchange rate, foreign exchange reserve size, capital import flows and preceding year budget performance, to determine the key assumptions underpinning the fiscal plan for the 2024 financial year.

Comparative Analysis of Key Budget Assumptions

| |

2024 |

2023 |

2022 |

| Crude Oil Price (Per Barrel) |

USD77.96 |

USD75 |

USD62 |

| Crude Oil Production (MBPD) |

1.78 |

1.69 |

1.86 |

| GDP Growth Rate |

3.88% |

3.75% |

4.2% |

| Inflation Rate |

21.40% |

17.16% |

13% |

| Exchange Rate (USD 1) |

NGN 800 |

NGN 435.57 |

NGN 410.15 |

Table 1: Comparison of key assumptions underlying Nigerian budgets from 2022 to 2024

Fig 1: Key assumptions in the 2024 budget

Fig 1: Key assumptions in the 2024 budget

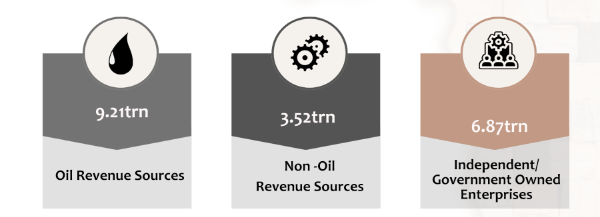

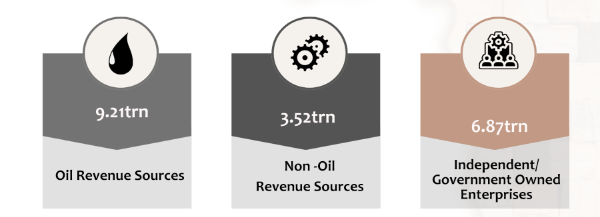

Key Elements of the Budget – Revenue summary

Of the total NGN28.78 Trillion required to fund this year’s budget; the Federal Government’s assumption on Total Revenue available to fund the Budget is estimated at NGN19.60 Trillion, with NGN9.21 Trillion projected to come from oil-related sources, NGN3.52 Trillion from non-oil sources, and NGN6.87 Trillion from other Independent sources, including revenue of GOEs (Government Owned Enterprises), aids, grants and social funds/Accounts receipts. Whilst many believe that the Federal Government’s 2024 Revenue assumptions are quite ambitious; the revenue assumptions underpinning the 2023 Appropriation Act returned quite close to call at the end of the financial year flaring the Government’s optimism for its forecasted income.

Fig 2: Summary of the revenue allocation in the 2024 budget

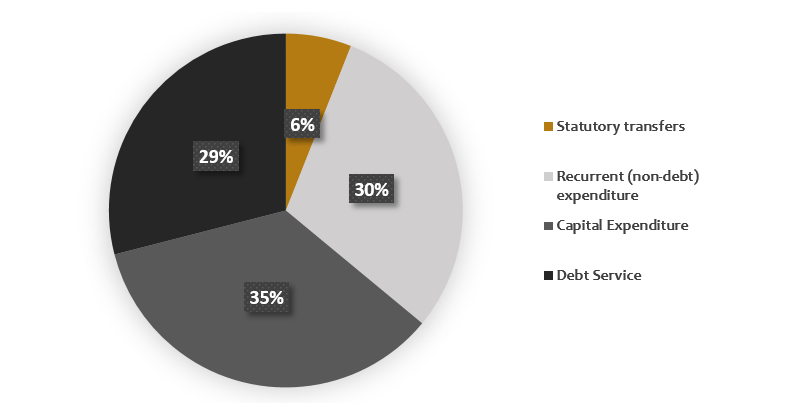

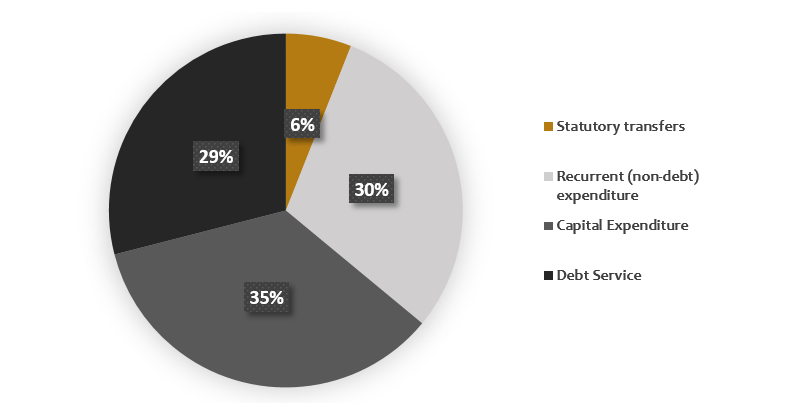

Key Elements of the Budget – Expenditure Summary

The Appropriation Act 2024 projects a total aggregate expenditure of NGN 28.78 Trillion, which is 10.9% higher than the total aggregate expenditure for 2023 including approved supplementary budgets.

The total aggregate expenditure for 2024 is projected to be NGN28,777,404,073,861, broken down as follows:

-

- Aggregate Capital expenditure is estimated at NGN9.99 Trillion (35% of the total aggregate expenditure)

- Recurrent (non-debt) expenditure is estimated at NGN8.7Trillion (30% of the total aggregate expenditure)

- Total Debt service is estimated at NGN8.27Trillion, representing 29% of the total aggregate expenditure

- Statutory transfers are estimated at NGN1.74 Trillion, representing 6% of the total aggregate expenditure

Of the total aggregate expenditure approved for the 2024 financial year, a total of NGN5.3 trillion is appropriated for the service of domestic debts, NGN2.748 trillion is appropriated for the service of foreign debts, while N223.662 billion is to be held in a Sinking Fund Account for the retirement of maturing promissory notes.

Fig 3: Percentage based representation of revenue allocation under the 2024 budget

| |

2024 |

2023 |

2022 |

| Aggregate Expenditure |

NGN28.7tn |

NGN21.83tn |

NGN17.13tn |

| Statutory transfers |

NGN1.743tn |

NGN967.49bn |

NGN869.67bn |

| Recurrent (non-debt) expenditure |

NGN8.769tn |

NGN8.33tn |

NGN6.91tn |

| Capital expenditure |

NGN9.995tn |

NGN6.46tn |

NGN5.47tn |

| Debt service |

NGN8.271tn |

NGN6.31tn |

NGN3.61tn |

| Sinking Fund |

NGN223.662bn |

NGN247.7bn |

NGN270.7bn |

Table 2: YOY Comparison of expenditure allocation in the budgets from 2022 – 2024

Key Elements of the Budget – Budget Deficit and Deficit Financing

The Budget deficit for the 2024 fiscal year stands at NGN9.179 trillion, representing 3.88% of our National GDP and representing a massive 33.38% reduction from the 2023 budget deficit. This downward trend evidences a demonstration of significant expenditure discipline. The NGN9.179Trillion Budget deficit is projected to be financed through asset sales/privatization which Federal Government estimates will return circa NGN298,486,421,740; multilateral/bilateral project-tied loans disbursements estimated at NGN1,051,914,486,314 and other debt financing sources estimated at NGN7,828,529,477,860.

The National Assembly has approved the Federal Government’s request to borrow USD7.8billion and EUR100 million as part of its 2022 – 2024 borrowing plan. The Loan Facilities which were initially approved on May 15, 2023 by the Federal Executive Council (FEC) under former President Muhammadu Buhari will be utilized in key priority sectors such as finance infrastructure, healthcare, education, agriculture and security amongst others.

Securitization of Ways and Means Advances from the CBN

The National Assembly on the 30th of December 2023 approved the securitization of the outstanding debit balance of NGN7.3 trillion Ways and Means Advance from the Federal Government.

Ways and Means is a loan facility through which the CBN finances the government’s budget shortfalls, made pursuant to section 38 of the CBN Act 2007, which stipulates that the apex bank may grant temporary advances to the federal government in respect of temporary deficiency of budget revenue provided such overdraft do not surpass five per cent of the government revenue from the previous year.

Analysis of the 2024 Budget – Key highlights

- Macroeconomic assumptions

Many schools of thought following the passage of the 2024 Appropriation Act have questioned the underlying assumptions in the budget given current macroeconomic realities and historic performance. For instance, the USD benchmark for the Budget is pegged at NGN800/1USD whereas as at the time of this publication the official exchange rate as published by the Central Bank is averaging NGN1400/USD. An overview of the Budget performance for 2023 also shows significant variation between the underlying macro-economic assumptions and the actual position; specifically in relation to inflation rate, foreign exchange rate and oil production levels giving a strong basis for the perceived pessimism. Benchmark inflation rate for 2023 was 17.6% relative to an actual inflation rate of 28.20% as of December 2023; Benchmark USD exchange rate was NGN437.57/USD1, whilst actual exchange rate was NGN853/USD1 as at December 2023. Similarly, oil production levels of 1.49mbpd was below the 2023 Budgetary assumption pegged at 1.69mbpd.

If the 2023 budget performance is anything to go by, it is safe to say that the 2024 Budget assumptions do not accurately reflect current macroeconomic trends raising concerns about increased deficit and the consequent borrowing to meet expenditure shortfalls.

- Ambitious Revenue Assumptions

Many have described the revenue assumptions underpinning the 2024 Budget as overly ambitious and doubtful; projecting a total NGN19.60 trillion revenue being a 54% increase relative to the 2023 revenue forecast. The assumptions around the benchmark price of crude oil and the projected daily oil production target of 1.78mbpd seems to be in complete dissonance with historical performance (Nigeria recorded an average production rate of 1.2mbpd over the last 2 years) and current market realities including decline in oil production, unabated oil theft and committed future production tied to swaps and forward contracts. Additionally, the increase in non-oil revenue assumptions from NGN2.43 Trillion in 2023 to NGN3.52 Trillion in 2024 seems not to have taken cognizance of shrinking economic activities, and lower consumption of VAT related goods due to ongoing economic hardship.

- Ways and Means Advances

The securitization of the due and outstanding NGN7.3 Trillion Ways and Means advance has remained one of the most debated elements of the 2024 fiscal plan; The continued reliance by the Federal Government on Ways and Means advances to fund budget deficits and subsequently requesting its securitization rather than repayment raises significant concern about budget discipline and Nigeria’s growing debt profile. Ways and Means Advances are primarily short-term, or emergency funding disbursed by the Central Bank of Nigeria to the Federal Government to fund delayed government cash receipts.

Whilst Section 38 of the CBN Act authorizes the Ways and Means Advances by the Central Bank; it limits the total available to draw amount to 5% of the actual revenue of the Federal Government for the preceding year, whilst also mandating that repayment be done within the same calendar year in which it is disbursed. Over the last 8 years Federal Government has continued to accrue ways and means liabilities without any reasonable repayment structure hence the pressure to restructure them into securitized loan notes. Recall that the National Assembly in 2023, similarly approved the President Buhari led Administration’s request to securitize about NGN22.7Trillion of ways and means obligations accrued during his 8 year tenure.

Following the National Assembly’s approval of the proposed Securitization, the Federal Government would issue debt notes to the Central Bank for a tenure of 40 years at an annual interest rate of 9% Per Annum (significantly less that the cost of carry of the CBN Ways and means Advance which was MPR+3%). Further, the loan will be included in the National Debt Profile for transparency.

It is important to note that the Ways and Means advances finds judicial backing in the provisions of Section 38 of the CBN Act. It is however also important to add that while Section 38 of the CBN Act empowers the CBN to advance this facility, the Act provides that the amount of such advances outstanding shall not at any time exceed 5% of the previous year’s actual revenue of the Federal Government and that all such advances when disbursed shall be repaid within the same Financial Year in which it is granted.

- The Emergency Economic Intervention Bill

Even though the President, in his speech, confirmed that current tax and fiscal laws are being reviewed to increase the ratio of revenue to GDP to 18 percent, the current administration unlike its predecessor has not passed a finance bill alongside its Appropriation Act. It is important to note however that the Presidential Fiscal Policy and Tax Reforms Committee Emergency has proposed an Economic Intervention Bill which appears to propose changes to certain tax and fiscal laws. It our considered opinion however, that when passed, the Emergency Economic Intervention Bill may support the implementation of the 2024 Budget and enhance the prompt realization of Federal Government’s revenue assumptions and government’s revenue generation plans.

Conclusion

With impressive continuity, the Bola Ahmed Tinubu led administration has kept to the culture of prompt passage of the Budget. Generally, the budget is quite ambitious as it generally takes a posture of increasing government spending to support real economic growth. Whilst the Government’s assumptions on revenue seem overly optimistic, there is a marked reduction in budget deficit and increased capital expenditure relative to recurrent expenditure. Despite concerns about some mismatch in the assumptions underpinning the Budget; key stakeholders generally remain optimistic about the potential of Nigeria’s biggest budget yet to deliver on the Federal Government’s mantra of “Renewed Hope”.

About DealHQ

We are an Africa Focused deal advisory/boutique commercial law firm focused on supporting businesses and positioning them to operate efficiently within their market sphere. We are known for our quality service delivery which is focused on attention to detail, creativity, timely execution and client satisfaction.

Our service offering includes: corporate commercial, real estate & construction, finance, capital markets & derivatives, mergers and acquisitions, private equity, infrastructure, technovation and data privacy, agriculture & commodities, business formations & start up support amongst others.

The content of this Article is not intended to replace professional legal advice. It merely provides general information to the public on the subject matter. Should you wish to seek specialist legal advice on this or any other related subject, you may contact us.

HOW TO GET STARTED

Do you need to know more about the Appropriation Act? Our Finance team is available to support you.

You may contact our team on: Email: info@dealhqpartners.com Telephone: +234 1 4536427 or +234 9087107575

Click here to download PDF

Recent Comments